2023 Market Outlook by Joseph Karl, CFA®

As we look ahead into 2023, many of those same challenges remain, fostering an environment of ongoing economic uncertainty. Given the degree to which the Federal Reserve Bank has raised interest rates, the economy will undoubtedly slow this year. The questions now are by how much and for how long? Moreover, we must ask what is in store for asset classes? While stocks and bond markets are forward-looking, to what extent are these uncertainties priced in, and will there be more volatility to come? We look to address these issues here in our 2023 outlook.

The Economy

The U.S. economy has, by and large, shown incredible resilience over the past year. Unemployment, which was at 3.9 percent at the start of 2022, moved down to 3.7 percent as of November. Retail sales for all of 2022 rose by 9.2 percent compared to 2021.¹

While these data points suggest fundamental aspects of the economy remain strong, it is the delayed effect of the Fed’s policies and the impact that it has on the economy that is creating concerns. To quote Federal Reserve Chairman Jerome Powell, “monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt.”

Inflation and Fed Policy

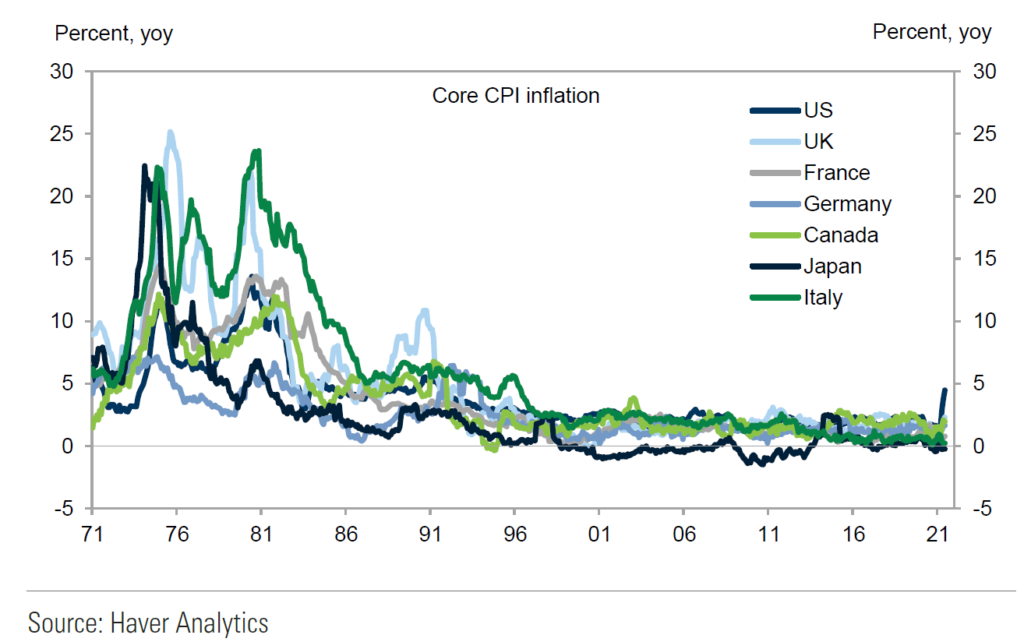

After years of stable prices, inflation roared back with a vengeance in 2022, reaching a high of 9.1 percent in June and closing the year at 5.7 percent. The increased costs for goods and services diminish consumers’ purchasing power, lower corporate profit margins, undermine the federal government’s policies, and ultimately reduce real economic growth. The longer inflation remains elevated, the more pervasive and persistent it becomes, and the more difficult it will be to remove. High inflation can undermine everything good about an economy; the quicker the Fed can contain it, the better. This is why the Fed has raised rates at a historically rapid rate.

The good news is that we see signs of improvement across the board with lower energy prices, declines in used car prices, reduced shipping rates, and easing rents. However, the Fed’s work is not done, and several factors will complicate its attempts to fine-tune its policy and slow the economy enough to bring down inflation without triggering a severe recession.

Russia-Ukraine War

The Russia-Ukraine war has put significant stress on the global economy, removing vast amounts of commodities, such as crude oil, natural gas and wheat, from the global supply. However, the U.S. is better positioned than most other countries to navigate these challenges. For example, the U.S. released oil from its strategic petroleum reserve, improving domestic supply and helping to lower oil prices. Nonetheless, markets will remain tight without a resolution between Russia and Ukraine, and modest increases in demand can lead to higher commodity prices.

Global Trade

Globalization, or the degree to which trade and technology have made the world more interconnected and interdependent, has increased significantly in recent decades. Of particular importance is China, which has grown to become the world’s second-largest economy. However, the degree to which China has helped keep global prices low and curb inflation is often taken for granted.

Source: Goldman Sachs, Asia Economics Analyst August 27, 2021

Tensions between the U.S. and China began to escalate with the 2016 trade war and were exacerbated by the pandemic. Since then, as the rest of the world reopened, China maintained a zero-COVID policy of frequent lockdowns and quarantines that restricted manufacturing capabilities, choked supply chains, impeded global trade, and contributed to rising global inflation. In late 2022, relations between the world’s two largest economies were further frayed when the U.S. restricted the sale of semiconductors to China, and China’s President Xi Jinping essentially handpicked himself for an unprecedented third term, giving him the power to pursue his party’s foreign policy goals. The question we now face is how far will Xi go to push China’s ambitions to become the world’s leader. To what extent will those efforts impact global trade, and how will they add to the current inflationary pressures?

Strong Labor Market

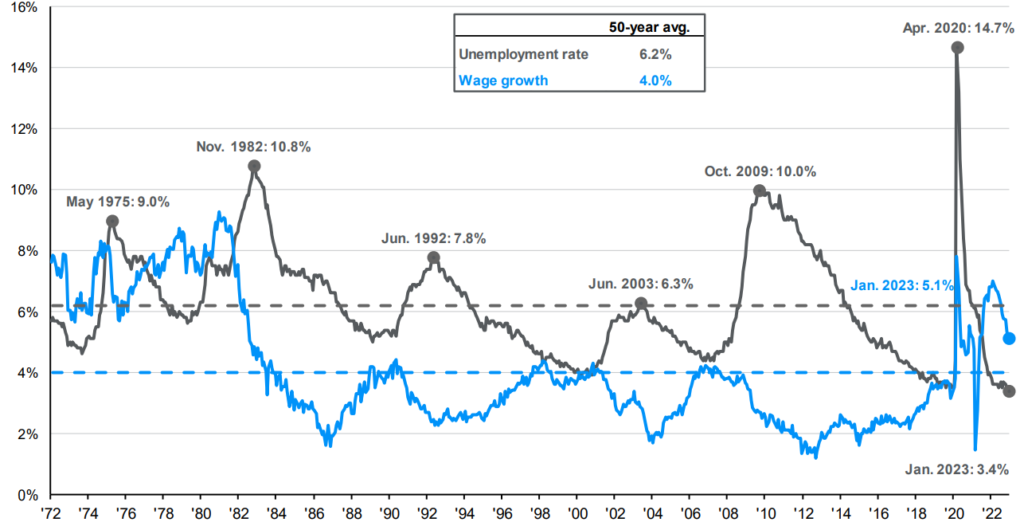

Arguably, the most important factor of a strong U.S. economy is a robust labor market. When people are employed and earning wages, they will continue to spend, and the economy can continue to grow. However, given the inflationary pressures of the past year, all of which are outside our control, the U.S. labor market is too hot. The chart below shows the current unemployment rate of 3.7 percent, which is well below the 50-year average of 6.2 percent. A strong labor market with low unemployment creates an environment where employers must compete for workers, which tends to push wages higher. As indicated below, the current wage growth of 5.8 percent is well above the 50-year average of 4.0 percent.

Source: JP Morgan Guide to the Markets, December 31, 2023

Although strong wage growth is favorable, wages that get too high add to inflationary pressures. This, combined with the Russia-Ukraine war and trade issues with China, amplify those inflationary pressures. Per comments from the Fed, they are looking for modest signs that wage growth is weakening.

Forward Guidance, Technology, and Information

It has been four decades since the U.S. has faced its current combination of challenges, which makes it even more difficult to try and gauge how well the economy will do in the year ahead. However, two factors give us optimism: The Fed has been providing forward guidance that the economy needs to slow somewhat to help offset the inflationary challenges. This has given individuals and businesses time to prepare accordingly and adjust for what may be in store. Secondly, with the information and technological advancements available today, consumers and businesses have time to allocate their resources more efficiently than they may have done 40 years ago. While this does not fix the U.S.’s current challenges, it does help the country navigate them more easily while staving off a major financial crisis.

Equities

The S&P 500 declined -18 percent in 2022, marking the worst returns since 2008. While high inflation, rising interest rates and concerns over the economy contributed to these results, the predominant driver was a 23 percent decline in valuations.

Over the long term, corporate earnings drive stock market returns. The more earnings grow, the higher stock prices they justify. Valuations over the longer term are mean reverting and should, in theory, be an insignificant source of returns. The challenges with gauging equity market returns in the current environment are twofold. Historically speaking, valuations are what initially move markets higher. With valuations close to their long-term averages and the degree of uncertainty and time it may take to get clarity on these challenges, there may be little upside for valuations in the near term. Additionally, earnings tend to bottom after the economy bottoms. This mismatch between the market’s forward-looking nature and the time it will take to gain further clarity on the economy complicates any assessment of where the markets are heading.

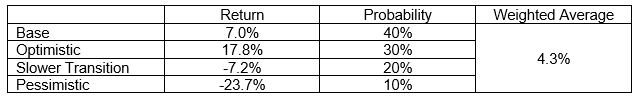

As always, we like to break equity returns down into the components of earnings, valuations and dividends and consider different scenarios to gauge the range where returns could be.

Despite 2022 declines, the forward price-to-earnings (P/E) ratio for the S&P 500 currently sits at its 25-year average, suggesting that equities are fairly valued relative to the next twelve months’ expected earnings. Consensus analyst expectations have corporate earnings coming in at 4.6 percent.² The question is, will valuations and earnings hold if the economy slows down materially? During recessions, valuations historically declined 25 percent. Last year, they fell 23 percent, making the argument that a recession is already priced into the market. Yet, it is important to note that high valuation levels marked the start of 2022. If we look at the Forward P/E at its lowest during the past five recessions, the average is still -28.8 percent below current levels. Earnings have historically declined by 13 percent but tend to decline less during periods of higher inflation.³

Base Case Scenario:

The Fed raises interest rates by 25 basis points in February and March but pauses thereafter as inflation shows continued signs of cooling. The economy flirts with a recession as economic data continues to weaken, but the labor market’s strength and wage gains continue to buoy the economy. A slowing economy leads to no growth in corporate earnings but signals that the economy is avoiding a severe slowdown. Inflation abates, leading to a 5 percent increase in valuations. Assuming dividends remain at their historical average of 2 percent, we would expect a return of 7 percent for 2023.

7% Total Return = 0% Earnings Growth + 5% Change in Valuations + 2% Dividends

Optimistic Scenario:

Forward guidance and rapid interest rate hikes from the Fed slow the economy enough to allow supply and demand to come into balance. We start to see the light at the end of the tunnel with the Russia-Ukraine war and avoid further tensions in U.S.-China relations. Under this scenario, we would expect earnings to come in better than current expectations, pushing valuations 10 percent above current levels. With dividends coming in at 2 percent, we would expect a return of 17.8 percent.

Slow-Transition Scenario:

While inflation cools, it remains stubbornly high given the broad array of other global challenges. The war between Russia and Ukraine continues, there is no clarity on U.S.-China relations, and U.S. economic data moves gradually weaker throughout the year, providing no real clues that the economy or markets have bottomed. Under this scenario, we would expect earnings to come in at -4.2 percent (the midpoint between current expectations and historical declines in recessions), with valuations declining another -5 percent and dividends at 2 percent with a total return of -7.2 percent.

Pessimistic Scenario:

Inflation remains persistent, forcing the global central banks to continue their restrictive policies. Despite 2022’s material declines in valuations, they remain 19 percent above their historical levels through the past five recessions. Under this scenario, we would expect earnings to decline -10.4 percent, valuations to decline -14.3 percent, and dividends to come in at 1 percent as businesses look to maintain cash. Under this scenario, we would expect a total return of -23.7 percent.

Fixed Income

Bond investors who may be a little skittish after the challenges of 2022 must remember that last year was one of the worst for bonds, and we are coming off extraordinarily low bond yields. Given the Fed’s accommodative monetary policies during the financial crisis and the pandemic, these challenges were expected, but they did occur far sooner than anticipated. For 2023, we expect a much better year for fixed-income investors while keeping a few factors top of mind:

1. The yield curve is inverted, with short-term rates much higher than long-term rates. For the first time in decades, cash and cash alternatives are yielding over 4 percent.

2. Central banks across the globe continue to unwind their accommodative quantitative-easing programs in a less favorable inflationary environment. Bond yields at the longer end of the yield curve tend to be driven by expectations for economic growth and inflation, although they have been suppressed for years. As central banks continue to unwind these policies, there could be bouts where longer-term yields move higher.

We believe that the worst is over for fixed-income investors and consider that some of the abovementioned factors could create pockets of opportunity. We are currently positioning portfolios with modestly shorter duration to reduce interest-rate sensitivity, but we will look to take advantage of opportunities to add exposure in the bond market.

Conclusion

Gauging precisely how the economy will do in 2023 is particularly challenging given the magnitude of the Fed’s attempts to slow inflation and the uncertain lag their interest rate hikes will have on the economy. While it will take some time before we get clarity, we have seen progress in many areas. Moreover, the economy’s resilience suggests the nation is adjusting to these challenges rather well. Given capital markets’ forward-looking nature, we believe a good degree of these uncertainties are already priced in, and 2023 will undoubtedly be better than last.

As always, we will continue to keep a close eye on how these developments evolve and will continue to keep you posted on our progress.

1. Census Bureau. www.census.gov

2. Factset Earnings Insight

3. Goldman Sachs; U.S. Equity Views; Recession Manual for U.S. Equities

About the Author: Joseph Karl, CFA, is chief investment strategist with Provenance Wealth Advisors (PWA), an Independent Registered Investment Advisor affiliated with Berkowitz Pollack Brant Advisors + CPAs, and a registered representative with Raymond James Financial Services. For more information, call (954) 712-8888 or email info@provwealth.com.

Provenance Wealth Advisors, 515 E. Las Olas Blvd., Ft. Lauderdale, FL 33301 (954) 712-8888.

Joseph Karl, CFA, is a registered representative of and offers securities through Raymond James Financial Services, Inc., Member FINRA/SIPC. Raymond James is not affiliated with and does not endorse the opinions or services of Berkowitz Pollack Brant Advisors + CPAs. PWA is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc., and Provenance Wealth Advisors.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of the advisors of PWA and not necessarily those of Raymond James. You should discuss any legal or tax matters with the appropriate professionals. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Every investor’s situation is unique, and you should consider your investment goals, risk tolerance and time horizon before making any investment. Investing involves risk, and you may incur a profit or loss regardless of strategy selected.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices generally rise. Past performance may not be indicative of future results. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. The above hypothetical examples are for illustration purposes only. Actual results will vary. Future performance cannot be guaranteed, and investment yields will fluctuate with market conditions. Diversification does not ensure a profit or guarantee against a loss.

To learn more about Provenance Wealth Advisors financial planning services click here or contact us at info@provwealth.com

Posted on February 9, 2023

← Previous