Managing Interest Rate Risk with Bond Ladders By Todd A. Moll, CFP®, CFA

Bonds are an important component of diversified portfolios because they offer investors predictable returns and reliable cash flow without the volatility of the public equity markets. However, this is not to say that bonds are not subject to risks. They are, especially in times of rising interest rates. The good news is you can mitigate some of this interest rate risk by employing a laddering strategy.

As a general rule of finance, bond prices have an inverse relationship with interest rates. This means that as interest rates rise, the value and yield of existing bonds decline as compared to newer bonds. To avoid this scenario, investors may instead create a bond ladder by purchasing a blend of short and long-term bonds that mature at different times over a certain period.

The size and structure of a bond ladder depend on an investor’s unique circumstances, including time to retirement, risk tolerance and goals. However, the aim is to have securities that mature every few months or every year. As bonds on the bottom rungs of the ladder mature, investors can reinvest those proceeds into longer maturity with higher yields on the ladder’s top rungs. If interest rates fall, reinvested proceeds will be at lower rates, but the remaining ladder will still be locked in and earning higher yields. Should investors need those proceeds, they could use the cash from maturing bonds without the risk of losing any principal.

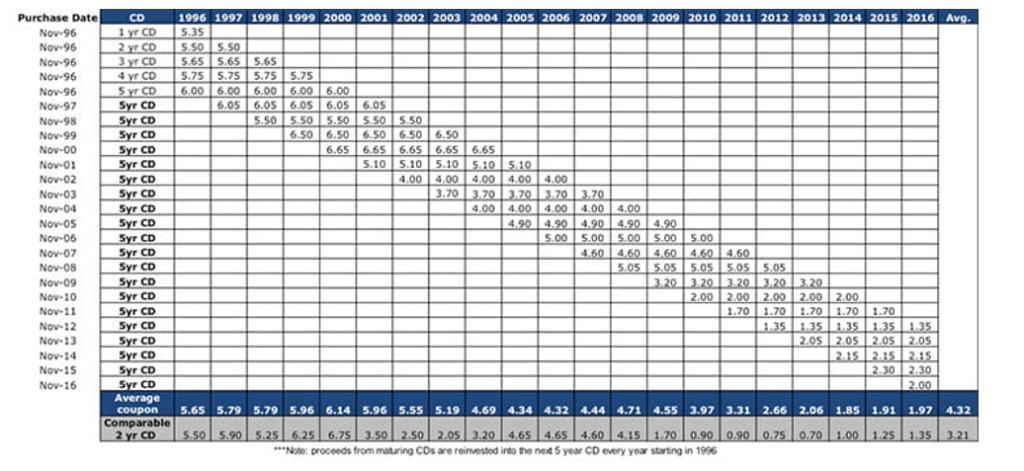

Raymond James offers the following example of how laddering maturities can minimize interest rate risks and potentially optimize the performance of the overall bond portfolio. The table below compares the historical 2-year CD versus a ladder of CDs rolled periodically.

This hypothetical portfolio had an approximate duration of 2.5, meaning that it would decline (appreciate) by 2.5 percent for every 1 percent move up (down) in interest rates. Please note that FDIC-insured brokered certificates of deposit differ from bank CDs. If investors redeem a bank CD before the stated maturity, they will pay an interest penalty. With a brokered CD, if the funds are needed before maturity, the CD is sold on the secondary market. Proceeds may be more or less than the original investment.

Working with experienced financial advisors can help investors navigate the full realm of investment opportunities and implement strategies designed to minimize risk and tax liabilities.

About the author: Todd A. Moll, CFP®, CFA, is a director and chief investment officer with Provenance Wealth Advisor (PWA), an Independent Registered Investment Advisor affiliated with Berkowitz Pollack Brant Advisors + CPAs and a registered representative with PWA Securities, LLC. He can be reached at the firm’s Fort Lauderdale, Fla., office at (954) 712-8888 or info@provwealth.com.

Provenance Wealth Advisors (PWA), 200 E. Las Olas Blvd., 19th Floor, Ft. Lauderdale, FL 33301 (954) 712-8888.

Todd A. Moll, CFP®, CFA, is a registered representative of and offers securities through PWA Securities, LLC, Member FINRA/SIPC.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Past performance is not a guarantee of future results. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

Any opinions are those of the advisors of PWA and not necessarily those of PWA Securities, LLC. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of PWAS, we are not qualified to render advice on tax or legal matters. You should discuss any tax or legal matters with the appropriate professional. Prior to making any investment decision, please consult with your financial advisor about your individual situation.

Every investor’s situation is unique. You should consider your investment goals, risk tolerance and time horizon before making any investment or withdrawal decision. Investing involves risk, and you may incur a profit or loss regardless of the strategy selected. There is an inverse relationship between interest rate movements and fixed-income prices. Generally, when interest rates rise, fixed-income prices fall, and when interest rates fall, fixed-income prices generally rise.

To learn more about Provenance Wealth Advisors financial planning services click here or contact us at info@provwealth.com

Posted on June 25, 2024

← Previous